Regarding Aloha score, emotional health, taxes and tax credits, and revenues…

Among others,

1. Any Hawaii residents and prospective residents, who attend emotional health classes or seminars, offered by State sponsored psychologists and related health professionals, may (could) get tax credits as well as higher aloha score, accordingly, (just like continuing education as Hawaii residents).

2. Any Hawaii residents and prospective residents, who volunteer at prospective multipurpose transitional homeless centers, would be able to improve their (low or damaged?, if any) aloha scores, accordingly (rather quickly, if served longer).

3. Hawaii residents and prospective residents may choose to pay higher taxes (in percentage but not in amounts, depending on the income level), in order to improve their low aloha scores, (since it would help increase the State revenues).

Just some of the ideas…lol.

Aloha.

About The Author

richkmililani@gmail.com

Doctor of Dental Surgery

(Columbia University, 1993)

Singer and Songwriter

ALOHA Activist and Reformer; Relatively Well Equipped with Law, Self-Taught (Unlicensed) Legal Expert with More Than 10 Years of Experience, and Some Practical Knowledge of Psychology.

Paid for by Richard Kim for Governor

95-1050 Makaikai Street, #8K

Honolulu, Hawaii 96789

Related Posts

I am the only candidate…

Dear voters, How is my candidacy different and unique? Among other things, 1. I am…

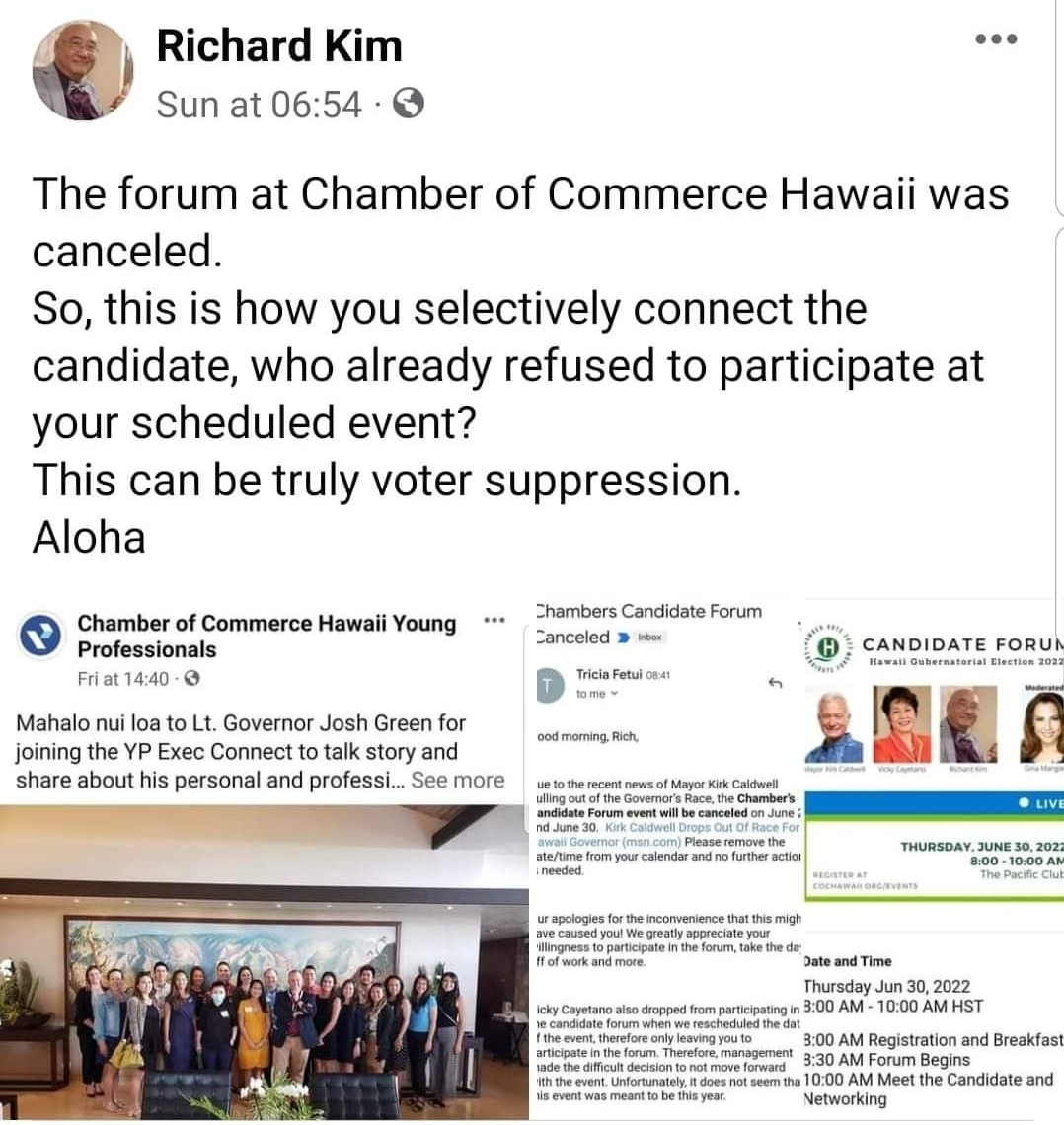

Another Voter Suppression!

Posted on May 31, 2022 but modified on June 2, 2022. Chamber of Commerce Hawaii…